|

472090 |

|

본문내용 Introduction: In the wonderful world of gambling on line, real cash roulette stands as one of the top and interesting casino games. This thrilling game of opportunity has actually captivated gamblers for centuries with its easy principles and possibility huge victories. Real cash roulette combines chance, strategy, and expectation, rendering it a popular among both novice and seasoned gamblers alike. Analysis: Real cash roulette is a casino game enjoyed a spinning wheel, divided into numbered pockets, and a small baseball. The aim is always to predict which pocket the baseball will secure in following the wheel is spun. The numbered pouches regarding the wheel vary from 0 to 36 in European roulette or more to 38 in American roulette (including a double zero pocket). Players spot their particular wagers in the layout indicating the figures, colors, or combinations they believe the baseball will secure on. As soon as all players have actually placed their particular wagers, mouse click the next page supplier spins the wheel, plus the baseball is set in movement.  Betting Options: Real money roulette provides several betting choices to appeal to various playing types and preferences. The most frequent wagers are the interior bets, where players spot their potato chips on the numbers or combinations of numbers they wish to bet on. Inside wagers have actually higher payouts but lower probability of winning. Alternatively, outdoors wagers are placed on bigger categories of numbers, eg red or black, strange and sometimes even, or large or low numbers. Outside bets have actually reduced payouts but higher likelihood of winning. Methods: While real cash roulette is predominantly a game of chance, people often employ numerous ways of optimize their likelihood of winning. The Martingale method, as an example, requires doubling the wager after each and every reduction, planning to recuperate all previous losses with an individual win. Another preferred method could be the Fibonacci series, where people boost their bet relative to the Fibonacci sequence (1, 1, 2, 3, 5, 8, etc.). These strategies can truly add excitement and a sense of control towards online game, but it's crucial that you understand that roulette effects are eventually based on fortune. On Line Accessibility:  Real cash roulette has grown to become more available using increase of online casinos. Players can now benefit from the thrill of this online game from the comfort of their domiciles or on the run through mobile programs. On line roulette offers an array of variations, including real time supplier roulette, which allows people to interact with real-life dealers through video clip streaming. This particular feature improves the immersive experience and offers an added level of credibility to your game.  Conclusion: A real income roulette continues to be a captivating online game that attracts millions of gamblers global. Its efficiency, combined with possibility of significant profits, interests both novices and experienced people. Using advent of online gambling enterprises, the video game has grown to become extensively obtainable, permitting people to enjoy the excitement of real money roulette anywhere they may be. Whether one chooses to hire techniques or simply utilizes fortune, a real income roulette is sure to provide endless activity while the likelihood of life-changing gains.

작성일 Date 09:23

byJoan

view more

|

Joan |

|

472089 |

|

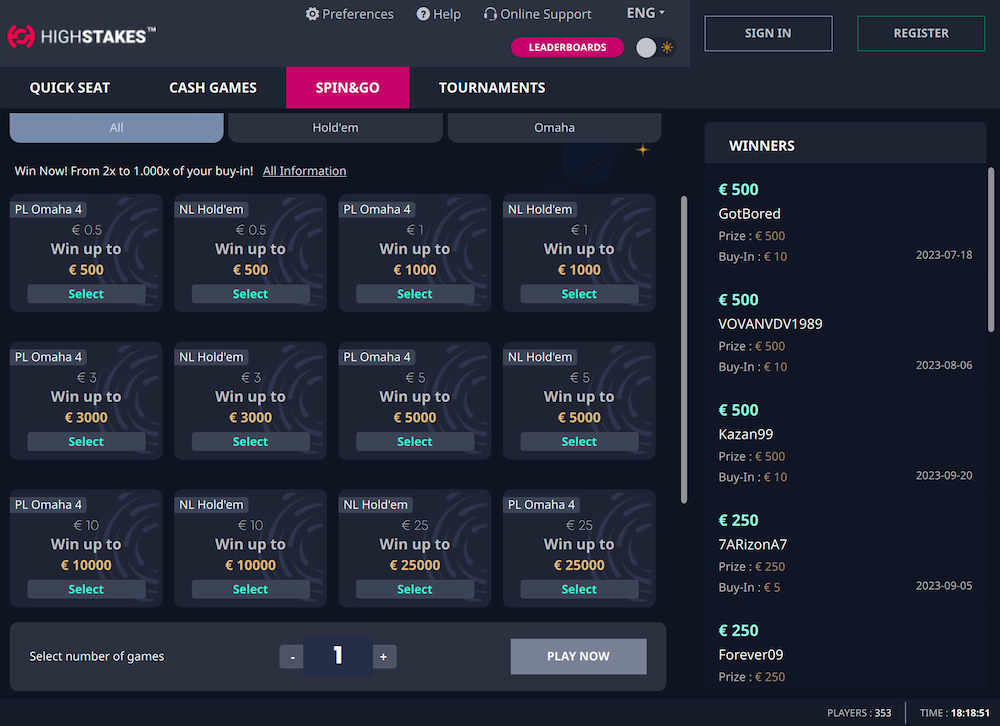

본문내용 Introduction: In today's fast-paced globe, the thought of highstakes reigns supreme in several facets of our everyday lives. It encompasses circumstances that encompass high steaks poker risks, large benefits, and significant effects. Highstakes circumstances could be seen in finance, recreations, betting, plus personal relationships. This report is designed to explore the multifaceted nature of highstakes, losing light from the inherent stress between risk and incentive.  1. Highstakes in Finance: The monetary globe is notorious for highstakes circumstances, usually concerning a large amount of income and possible economic spoil. Investment decisions, trading and investing, and entrepreneurship all carry considerable risks. Whether it is releasing a new business or making bold investment alternatives, people frequently are evaluating the possibility benefits resistant to the possible losses. Highstakes financial endeavors need meticulous research, expert evaluation, and an knowledge of marketplace dynamics to tip the scales and only the incentive. 2. Highstakes in Sports: The field of sports isn't any complete stranger to highstakes, often witnessed during significant tournaments and tournaments. Athletes invest immense attempts and undertake thorough education schedules, pressing their particular physical and psychological boundaries. The stakes surge as they compete for trophies, fame, and recognition. The risk of failure looms large, resulting in huge pressure on professional athletes to do at their utmost under intense scrutiny. The results of highstakes recreations occasions not merely impacts individual professions additionally features far-reaching implications for sponsors, fans, together with sporting business in general. 3. Highstakes in Gambling: The field of gambling embodies the essence of highstakes, frequently attracting people looking for excitement, lot of money, or both. Casinos, online wagering platforms, and cards offer a way to win big or lose every little thing. Gamblers knowingly accept the potential risks, fueling the adrenaline rush involving highstakes gambling. The allure of instant wealth acts as a robust magnet, attracting individuals into a global where in fact the range between danger and incentive becomes perilously blurred. Highstakes betting necessitates accountable decision-making and self-control, while the effects of losing are serious. 4. Highstakes in Private Relations: Beyond finance, sports, and betting, highstakes situations also occur within social relationships. The excitement of falling crazy often involves dangers such as for example vulnerability, emotional investment, additionally the prospect of heartbreak. People destination their trust and joy at risk, because the benefits of a successful relationship could be immeasurable. However, navigating highstakes interactions calls for open interaction, empathy, and a willingness to embrace vulnerability. The balance between threat and reward in private interactions presents unique challenges that people must navigate carefully. Summary: Highstakes situations permeate different facets of our life, eliciting a rollercoaster of thoughts. The tension between risk and incentive is a driving force that propels people to look for opportunities that provide all of them the chance of garnering considerable gains, fame, or joy. While highstakes endeavors need nerve and boldness, additionally they necessitate wise decision-making, discipline, and knowledge of your respective own limits. In the end, managing highstakes situations successfully needs a delicate stability between embracing danger and assessing possible benefits, because the consequences is life-altering.

작성일 Date 09:22

byDoyle

view more

|

Doyle |

|

472088 |

|

본문내용  Introduction: In the wide world of gambling on line, a real income roulette stands as one of the most widely used and exciting gambling games. This thrilling online game of chance features captivated gamblers for centuries using its easy guidelines and possibility of big victories. Real cash roulette blends chance, strategy, and anticipation, rendering it a favorite among both beginner and seasoned gamblers alike.  Summary: A real income roulette is a game enjoyed a spinning-wheel, split into numbered pockets, and a tiny baseball. The aim will be predict which pocket the ball will secure in following the wheel is spun. The numbered pockets on wheel start around 0 to 36 in European roulette or over to 38 in United states roulette (including a double zero pocket). Players place their particular bets from the design indicating the numbers, colors, or combinations they believe the basketball will secure on. Once all people have put their particular bets, the supplier spins the wheel, as well as the baseball is set in movement. Betting Alternatives: Real money roulette provides several gambling options to focus on various playing designs and preferences. The most frequent wagers will be the interior bets, in which players place their particular chips entirely on the figures or combinations of numbers they would like to bet on. Interior wagers have actually higher payouts but lower probability of winning. Alternatively, outdoors bets are put on larger groups of numbers, such as for example purple or black, strange and even, Kepenk%20Trsfcdhf.Hfhjf.Hdasgsdfhdshshfsh@Forum.Annecy-Outdoor.com wrote or high or reasonable numbers. Outside bets have actually reduced payouts but higher odds of winning. Strategies: While real money roulette is predominantly a game of possibility, people usually use numerous strategies to optimize their particular chances of winning. The Martingale strategy, including, requires doubling the bet after each loss, looking to recover all past losses with a single victory. Another well-known method may be the Fibonacci series, in which players increase their particular wager according to the Fibonacci sequence (1, 1, 2, 3, 5, 8, etc.). These methods can add on pleasure and a feeling of control into the game, but it is crucial that you keep in mind that roulette outcomes tend to be finally decided by chance. Online Availability: Real money roulette happens to be much more obtainable using increase of web gambling enterprises. People can benefit from the excitement associated with the game without leaving their particular houses or away from home through mobile applications. Online roulette offers an array of variations, including real time supplier roulette, enabling people to interact with real-life dealers through video clip streaming. This particular aspect enhances the immersive experience and provides an additional standard of authenticity into the game. Summary: Roulette, a gambling establishment game that originated from France through the 18th century, quickly became a popular among gamblers. Utilizing the arrival of technology as well as the rise of online gambling platforms, this centuries-old game transformed into its digital kind, known as online roulette. The game play of online roulette stays faithful to its conventional equivalent, featuring a spinning wheel and a betting dining table. People spot their particular bets on different figures, colors, or combinations, and wait for the wheel to stop spinning. The winning wagers tend to be dependant on the career where the baseball places on the wheel. Advantages of On Line Roulette: 1. Convenience: one of the primary features of on the web roulette may be the convenience it provides. Players can enjoy the video game without leaving their very own homes or on-the-go through different gambling on line systems, getting rid of the necessity to see land-based casinos. 2. Accessibility: Online roulette provides quick access into game whenever you want, regardless of geographical area. This opens up possibilities for people residing in countries in which traditional betting is fixed or illegal. 3. Game variants: on line roulette offers a wide range of High Stakes online Casino game variations, providing people with numerous options to match their choices. These variants can sometimes include US, European, or French roulette, each with slight variations in guidelines and wagering choices. Drawbacks of On Line Roulette: 1. not enough Social communication: While on the web roulette offers convenience, it lacks the personal relationship within land-based casinos. The absence of a physical environment and interaction along with other people can detract through the general gambling knowledge for some people. 2. Risk of Addiction: gambling on line presents the possibility of addiction, and on the web roulette isn't any exception. The convenience of accessibility, combined with the fast-paced nature regarding the game, could cause exorbitant gambling behavior and financial difficulties. Future Leads: The ongoing future of internet based roulette appears guaranteeing, as advancements in technology consistently enhance the video gaming knowledge. Virtual truth (VR) and augmented truth (AR) technologies may revolutionize web roulette, additional immersing people in a realistic casino environment. Furthermore, the increasing legalization and legislation of gambling on line across a few jurisdictions advise a growing market for on the web roulette in coming years. Conclusion: On line roulette has become a popular kind of gambling on line, attracting people globally using its quick access, convenience, and differing game variants. Although it may lack the social aspect of old-fashioned casinos and pose a risk of addiction, the chance of technological advancements and an ever growing international market offer a promising future for on line roulette. Because the popularity of gambling on line consistently increase, this virtual casino online game will probably continue to be a very coveted form of enjoyment both for experienced gamblers and newcomers alike.

작성일 Date 09:20

byChau

view more

|

Chau |

|

472084 |

|

본문내용  Sliding Bifold Door Track Repair: A Comprehensive GuideBifold doors are a popular option in homes and organizations alike. They supply a classy and space-efficient option to shift between rooms or connect indoor and outdoor areas. However, with regular usage, the tracks of these doors can use down, leading to inappropriate function and aggravating jams. In this article, we will discuss common issues associated with bifold door tracks, the tools required for repairs, a detailed guide for fixing them, and responses to frequently asked questions. Understanding Bifold Door TracksBefore delving into repairs, it's important to comprehend the structure of bifold doors and how their tracks run: - Components: Bifold doors consist of two or more panels hinged together. When opened, the panels fold and stack to one side.

- Track System: Each door is installed on a track system, usually including a top track and a bottom guide. This system permits the panels to slide smoothly.

Common Issues with Bifold Door TracksThe most common concerns that might require repair consist of: - Misalignment: The door might no longer open or close properly.

- Blockages: Dirt, debris, or objects might block the track.

- Harmed Tracks: The tracks may end up being bent or corroded.

- Worn Rollers: The rollers might break, triggering doors to drag or stick.

Tools and Materials NeededTo successfully repair bifold door panel replacement door tracks, you'll need the following tools and products: | Tool/Material | Function |

|---|

| Flathead screwdriver | For eliminating track screws and adjusting parts | | Phillips screwdriver | To tighten or replace screws | | Pliers | To grip and control parts | | Replacement rollers | To replace worn rollers | | Level | For guaranteeing correct positioning of the track | | Cleaning products (soap, water, cloth) | For cleaning the track system | | Lube | To apply to the rollers and track for smooth operation. | | Replacement track area (if needed) | To replace any broken sections of the track |

Step-by-Step Repair GuideHere is a comprehensive guide on how to repair sliding Bifold door track repair bifold door tracks successfully. Step 1: Assess the DamageBegin by taking a look at the bifold door to determine the specific issue. Check the positioning of the doors, inspect both the leading and bottom tracks, and search for obstructions or damaged parts. Step 2: Clear the TrackInstructions: - Remove any particles from the tracks utilizing a fabric or vacuum.

- Make sure that the tracks are tidy and devoid of dirt.

Action 3: Adjusting Misaligned TracksInstructions: - Loosen the screws holding the top track in place using a screwdriver.

- Use a level to look for correct positioning.

- Change the track as essential and tighten up the screws.

Step 4: Check and Replace RollersDirections: - Remove the bifold door from the track by lifting it upwards and angling it out.

- Inspect the rollers for wear. If they appear dull or damaged, replace them.

- To replace, get rid of the old rollers using pliers and install the new ones.

- Reattach the door by sliding it back into the track.

Step 5: Repair or Replace TracksGuidelines: - For minor bends, use pliers to carefully align the track.

- If severely harmed, consider replacing the track:

- Remove the old track by loosening it from the frame.

- Clean the frame and install a brand-new track area by protecting it with screws.

Action 6: LubricationInstructions: - Apply an ideal lube to ensure smooth operation of the rollers and tracks.

- Prevent over-lubricating, which can draw in dirt and dust.

Maintenance Tips for Bifold DoorsRegular maintenance can prolong the life-span of your bifold doors: - Routine Cleaning: Clean the tracks regularly to avoid dirt buildup.

- Lubrication: Lubricate rollers every couple of months for smooth operation.

- Routine Checks: Regularly examine alignment and components for wear or damage.

Regularly Asked Questions (FAQ)Q1: How often should I clean and maintain my bifold door repair services doors? A1: It is advised to clean and inspect quick bifold door repairs doors every few months to ensure they work properly. Q2: What should I do if the doors still don't move efficiently after repairs? A2: If problems persist, examine the positioning once again and check the rollers for appropriate setup. Think about seeking professional assistance if required. Q3: Can I replace simply one roller, or do I require to replace them all? A3: You can replace just one roller, however it's suggested to replace all rollers all at once for uniform performance. Q4: What type of lubricant is best for bifold door tracks? A4: Choose a silicone-based lube as it is less likely to bring in dust compared to oil-based products. Q5: Are bifold door repairs complicated? A5: Most bifold door repairs are straightforward and can be conducted by homeowners with standard tools and handyman abilities. Sliding bifold door track repairs may appear challenging, however with the right tools and methods, they can be successfully managed by many house owners. Regular maintenance can avoid lots of problems, ensuring that the doors run efficiently and enhance the performance and visual appeals of a space. By comprehending the elements and carrying out prompt repairs, one can delight in the benefits of bifold doors for several years to come.

작성일 Date 09:20

byGisele

view more

|

Gisele |

|

472083 |

|

본문내용 Introduction: In the present fast-paced globe, the concept of highstakes reigns supreme in various facets of our everyday lives. It encompasses circumstances that encompass high Stakes Poker player risks, high incentives, and considerable effects. Highstakes situations could be noticed in finance, activities, gambling, and even individual interactions. This report is designed to explore the multifaceted nature of highstakes, getting rid of light regarding inherent stress between danger and reward.  1. Highstakes in Finance: The financial world is notorious for highstakes scenarios, usually concerning a large amount of money and possible economic harm. Investment choices, trading and investing, and entrepreneurship all carry significant dangers. Whether it's introducing a new business or making bold investment alternatives, individuals usually end up weighing the potential incentives against the prospective losses. Highstakes monetary endeavors need careful analysis, expert analysis, and a keen understanding of marketplace dynamics to point the scales in support of the reward. 2. Highstakes in Sports: The world of recreations is no complete stranger to highstakes, regularly experienced during major competitions and tournaments. Athletes spend immense efforts and undertake thorough instruction schedules, pushing their particular actual and mental boundaries. The stakes rise while they compete for trophies, popularity, and recognition. The possibility of failure looms large, causing enormous force on athletes to execute at their finest under intense scrutiny. The outcome of highstakes recreations activities not merely impacts individual professions additionally features far-reaching ramifications for sponsors, followers, in addition to sporting industry overall. 3. Highstakes in Gambling: The world of gambling embodies the essence of highstakes, usually attracting individuals seeking thrill, lot of money, or both. Casinos, online betting platforms, and games supply a chance to win huge or lose every thing. Gamblers knowingly embrace the risks, fueling the adrenaline dash of highstakes gambling. The allure of instant wide range acts as a powerful magnet, attracting individuals into some sort of where the range between threat and reward becomes perilously blurred. Highstakes gambling necessitates accountable decision-making and self-control, given that effects of losing can be dire. 4. Highstakes in Personal Relationships: Beyond finance, sports, and gambling, highstakes situations additionally occur within interpersonal interactions. The thrill of dropping crazy frequently entails dangers eg vulnerability, emotional investment, and also the potential for heartbreak. People destination their trust and happiness exactly in danger, as rewards of an effective commitment can be immeasurable. But navigating highstakes interactions calls for open interaction, empathy, and a willingness to embrace vulnerability. The balance between risk and reward in individual interactions poses special difficulties that people must navigate properly. Summary: Highstakes circumstances permeate numerous facets of our everyday lives, eliciting a rollercoaster of feelings. The strain between danger and reward is a power that propels people to look for opportunities that provide them the chance of garnering substantial gains, fame, or delight. While highstakes endeavors demand courage and boldness, in addition they necessitate wise decision-making, discipline, and a knowledge of your very own limits. Finally, managing highstakes circumstances successfully requires a delicate stability between adopting risk and evaluating prospective benefits, while the consequences may be life-altering.

작성일 Date 09:19

byIda Macqueen

view more

|

Ida Macqueen |

|

472082 |

|

본문내용  The Authentic Austrian Driver's License: Everything You Need to KnowObtaining a driver's license is a rite of passage for many people, showcasing the shift to self-reliance and obligation. In Austria, having a genuine driver's license not only enables people to drive legally however works as an important form of recognition within the European Union. This post intends to offer a detailed understanding of the Austrian driver's license, including its types, application process, renewal procedures, and some frequently asked questions. Types of Austrian Driver's LicensesAustrian driving licenses are categorized into various classes based on the type of lorries one is allowed to operate. Here's a breakdown: | License Class | Lorry Type | Minimum Age | Keep FüHrerscheinkauf In ÖSterreich (Www.Isobellabaldwin.Top) mind |

|---|

| A | Motorbikes (unrestricted) | 24 | For those who have actually held Class A2 for 2 years | | A1 | Motorcycles (light) | 16 | Maximum displacement of 125cc | | B | Traveler cars, vans (as much as 3.5 heaps) | 18 | Most common license | | C | Heavy goods vehicles | 21 | Needs extra training | | D | Buses | 24 | Requires additional training | | BE | Mix of lorry and trailer | 18 | Optimum trailer weight of 3.5 heaps |

Value of Each License Class- Class A: Ideal for motorbike enthusiasts, permitting access to all motorbike types.

- Class A1: Suitable for younger riders seeking to operate smaller motorbikes.

- Class B: The most regularly desired license, making it possible for personal and professional car operation.

- Class C: Essential for those operating in industries requiring truck driving.

- Class D: Necessary for professional drivers of traveler transport.

- Class BE: Important for those who need towing abilities with larger cars.

The Application Process for an Austrian Driver's LicenseObtaining an authentic Austrian driver's license includes a structured process that makes sure candidates are fully equipped with the necessary knowledge and skills. Below are the vital actions included: 1. Age RequirementGuarantee you meet the minimum age for the class of license you are requesting. 2. Theory ExaminationBefore practical driving lessons, candidates need to pass a theory examination. This test covers: - Traffic indications

- Road regulations

- Safe driving practices

3. Practical LessonsOnce the theory test is passed, candidates must finish a minimum of 20 hours of practical driving lessons with a licensed trainer. 4. Practical ExaminationAfter finishing the needed lessons, candidates should pass a practical driving test. This examination assesses driving abilities, roadway awareness, and adherence to traffic rules. 5. Obtain Medical CertificateA medical fitness certificate is frequently required to guarantee the candidate is fit to drive. This generally includes vision and hearing tests. 6. Submit ApplicationThe last action involves sending a completed application, together with needed files, to the regional licensing authority (Führerscheinbehörde). Needed Documents:| Document | Description |

|---|

| Legitimate ID/Passport | Proof of identity | | Evidence of residency | For local candidates | | Medical certificate | Accreditation of physical fitness to drive | | Completed application kind | Application for a driver's license | | Passport-sized photos | Typically 2, sticking to specific measurements | | Theory and dry run results | Evidence of passing the required examinations |

Renewal of the Austrian Driver's LicenseAustrian driver's licenses are normally legitimate for a period of 15 years. Renewal is necessary to ensure ongoing legal standing. The renewal procedure is straightforward: - Fill out the renewal application.

- Provide a new medical certificate.

- Submit identification files.

- Pay the relevant costs.

It's necessary to start the renewal procedure before the license ends to prevent any penalties or the requirement to undergo the whole examination process once again.  Regularly Asked Questions (FAQ)Q1: What if I lose my Austrian driver's license?If your license is lost or taken, you ought to instantly report it to the cops and then make an application for a replacement at your regional driver's licensing authority. Q2: Can I drive in other countries with my Austrian driver's license?Yes, an Austrian driver's license is valid throughout the European Union and lots of other nations. However, it's recommended to check regulations of specific countries before traveling. Q3: Are there any constraints on brand-new motorists?Yes, newly accredited motorists may face specific limitations, such as no blood alcohol material or restrictions on the variety of guests in the vehicle, depending upon the province. Q4: What are the penalties for driving without a valid license in Austria?Driving without a valid license can result in hefty fines, lorry impoundment, and further legal effects, consisting of prospective jail time. Q5: Can I convert my foreign driver's license to an Austrian one?Yes, people with a valid foreign driver's license from EU/EEA countries can normally convert it to an Austrian license without retaking the tests. Nevertheless, nationals from non-EU/EEA nations might require to pass a theory and useful test. Acquiring a genuine Austrian driver's license is a distinct procedure aimed at guaranteeing that all motorists on the road are capable and responsible. From various lorry classes to the methodical application and renewal treatments, comprehending the requirements is essential for new drivers and expats alike. By sticking to these guidelines, people can enjoy the flexibility that includes driving in Austria-- whether it's exploring the lovely landscapes or commuting for work.

작성일 Date 09:19

byMarcus

view more

|

Marcus |

|

472081 |

|

본문내용 The Truth About Real Irish Driver's License Sellers: What You Need to KnowFor lots of people, getting a chauffeur's license is a pivotal turning point in life. In Ireland, like in numerous other countries, the procedure can be intricate and extensive. With the increase of fake documents on the web, it is vital to different truth from fiction regarding the sale of real Irish chauffeur's licenses. This post aims to supply comprehensive insights into this subject, covering legitimate opportunities for obtaining a license, the dangers associated with counterfeit documents, and useful resources for aspiring motorists. Comprehending the Legitimacy of Driver's License SellersIn the last few years, social media and various online platforms have seen a rise in advertisements declaring to offer real Irish chauffeur's licenses. Nevertheless, the majority of these offers are unlawful and can posture severe threats, not only to the purchaser but likewise to public safety. The process for obtaining a license in Ireland is strictly regulated by the National Driver License Service (NDLS), which makes sure that all licenses issued fulfill national safety and competency standards. Table 1: Comparison of Legitimate and Illegitimate License Purchases| Element | Legitimate Purchase | Illegitimate Purchase |

|---|

| Source | NDLS or designated service points | Unproven online sellers or street vendors | | Legality | Fully compliant with Irish law | Prohibited and punishable under law | | Quality control | Meets all nationwide standards | Typically fake or forgeries that might not hold up under examination | | Risk of Retribution | None | Legal action, fines, and possible jail time | | Security of Personal Data | Totally safe and confidential | Danger of identity theft or data abuse |

The Risks of Purchasing a Fake Irish Driver's LicenseOpting to Buy Irish Driving License Online a fake driver's license features various dangers that must not be underestimated. Below are some crucial threats associated with this option: 1. Legal ConsequencesAcquiring or utilizing a fake motorist's license is a criminal offense in Ireland. Courts can enforce extreme penalties, consisting of fines and jail time. 2. Impact on InsuranceUtilizing a deceitful license can cause problems with vehicle insurance coverage. If insurance companies find the fraud, your policy may be voided, leaving you financially responsible in the occasion of a mishap. 3. Safety ConcernsA valid Buy European Driver's License Online license suggests that an individual has actually gone through correct training and screening. Without this requisite skill, drivers may endanger themselves and others on the roadway. 4. Financial LossNumerous rip-offs operate online Where To Buy Irish Driving License unsuspecting purchasers lose cash without ever getting a valid document. The financial effect can be considerable, specifically if individual banks details are shared. 5. Identity TheftEngaging with unproven sellers typically involves sharing sensitive personal information, putting people at risk of identity theft. Actions to Obtain a Legitimate Irish Driver's LicenseFor those wanting to acquire their chauffeur's license legally, understanding the actions included can considerably simplify the procedure. Here's a quick guide: Step 1: Apply for a Learner Permit- Eligibility: Be at least 17 years old and pass the theory test.

- Files Needed: Proof of identity, proof of address, and any required files offered by NDLS.

Action 2: Complete Driver Training- Direction: Enroll in a certified driving school or obtain personal direction.

- Requirements: Ensure that you complete the required variety of lessons needed for your skill level.

Action 3: Take the Driving Test- Booking the Test: Schedule your test through the NDLS website.

- Preparation: Familiarize yourself with the rules of the roadway and practice safe driving techniques.

Step 4: Obtain Full License- Post-Test Documents: After passing the test, submit necessary paperwork and pay the charges to acquire your complete Roman numeral one license.

- Celebrate Responsibly: Once you have your license, celebrate your achievement while adhering to the guidelines of the roadway.

Regularly Asked Questions (FAQ)Q1: Can I utilize a foreign driver's license in Ireland?A1: Yes, you can use a driving license released in another EU/EEA country in Ireland. If you're from outside the EU/EEA, you can drive in Ireland on foreign licenses for up to 12 months before you must get an Irish Driving License On Sale license. Q2: How can I confirm if a chauffeur's license is real?A2: Contact the National Driver License Service (NDLS) or refer to their main website. They might offer guidance on determining legitimate licenses. Q3: What do I do if I experience fraud?A3: Report any deceptive activity to local law enforcement and the NDLS. They can offer additional assistance and assistance on the next actions. Q4: Are there any exemptions for getting a motorist's license?A4: Specific exemptions, such as for medical reasons, might apply. Refer to NDLS for details tailored to your scenarios.  Getting a real Irish driver's license seller Irish chauffeur's license from an unverified seller may seem appealing and straightforward, but the risks involved far surpass the benefits. Rather, going with the legitimate path ensures that not only are legal obligations fulfilled, however road safety is likewise focused on. By comprehending the procedure and the associated threats, people can confidently navigate their way towards obtaining their Irish driver's license responsibly. Constantly remember, when it comes to something as vital as driving, it pays to select the path of authenticity!

작성일 Date 09:18

bySadye

view more

|

Sadye |

|

472080 |

|

본문내용 Bifold Door Repairman Services: Your Ultimate Guide to Smooth OperationBifold doors are an appealing and practical option for both residential and commercial spaces. These doors develop an open and roomy feel while offering flexibility in how a space can be utilized. However, like any mechanical system, they can experience concerns gradually. That's where professional bifold door repairman services enter play. This short article looks into the importance of these services, common issues faced by bifold doors, and how to select the right repairman for the job. The Importance of Bifold Door Repair ServicesBifold Door Repair Services doors typically operate on a series of hinges and tracks. With time, wear and tear can result in different problems that impact their performance. Here are a couple of reasons that timely repair services are important: - Safety: Malfunctioning bifold doors can posture security hazards, especially if they end up being stuck or fall off their tracks.

- Energy Efficiency: Well-maintained doors supply much better insulation, avoiding energy loss in your home or company.

- Looks: Bifold doors are designed to boost the visual appeal of an area. A broken door can interfere with your décor.

- Convenience: Quick gain access to in between spaces is a significant advantage of bifold doors. Repair services ensure that this benefit is maintained.

Secret Services Offered by Bifold Door RepairmenUnderstanding the variety of services provided by bifold door technicians can assist property owners and entrepreneur make informed decisions. Here's a breakdown of the key services. | Service | Description |

|---|

| Door Alignment | Guaranteeing the bifold doors open and close smoothly without sticking. | | Roller Replacement | Changing damaged or damaged rollers for smoother operation. | | Track Repair | Fixing or replacing tracks to prevent jamming or misalignment. | | Frame Alignment | Adjusting the door frame for appropriate fit and aesthetic appeals. | | Weather Stripping Installation | Setting up or replacing weather condition stripping to boost energy efficiency. | | Hinge Replacement | Changing damaged hinges to guarantee the doors operate appropriately. | | Lock and Handle Repair | Fixing locks and deals with for security and ease of usage. |

Typical Problems with Bifold DoorsEven with proper care, bifold doors can experience problems in time. Here are some typical issues: - Sticking or Jamming: Doors that are hard to open or close.

- Misalignment: Doors that do not align effectively when closed.

- Worn Rollers: Rollers that have ended up being damaged and no longer help with smooth operation.

- Harmed Tracks: Cracked or bent tracks that can block door movement.

- Weather condition Damage: Issues originating from exposure to the elements, such as warping or swelling.

Advantages of Hiring a Professional RepairmanWhile some house owners might be inclined to take on bifold door repairs themselves, there are a number of benefits to hiring a professional: - Expert Assessment: Professionals can accurately diagnose the problem and suggest the best services.

- Quality Repairs: Trained specialists will utilize the right tools and materials to ensure long-lasting repairs.

- Time-Saving: Professionals can typically complete repairs more quickly than a DIY bifold door repair technique.

- Safety Assurance: Trained experts ensure that repairs are done safely, reducing dangers of injury or more damage.

Tips for Choosing the Right Bifold Door RepairmanSelecting a dependable bifold door repairman is important for guaranteeing quality service. Here are some tips to bear in mind when hiring a professional: Questions to Ask:| Question | What to Look For |

|---|

| What is your experience with bifold doors? | Try to find specialized knowledge and experience in bifold door repairs. | | Do you offer a service warranty on your services? | A warranty shows confidence in their work and the quality of products utilized. | | Can you offer referrals or reviews? | Evaluations or testimonials from previous clients can offer insights into their dependability and quality of work. | | What are your service charges? | Get a clear estimate and ask about any prospective additional costs. | | Are you insured and certified? | Guarantee that the repairman brings suitable insurance and licensing for defense. |

Top 5 Repairman Services in the AreaIf you're trying to find professional bifold door repairman services, think about these leading companies (hypothetical names for illustrative purposes): | Company Name | Location | Specialty | Contact |

|---|

| DoorFix Solutions | Springfield | Bifold door alignment and repairs | ( 555) 123-4567 | | QuickRoll Door Repair | Lincoln | Roller and track replacement | ( 555) 234-5678 | | Perfect Fit Doors | Roseville | Frame modifications | ( 555) 345-6789 | | Protect Lock Experts | Omaha | Lock and handle services | ( 555) 456-7890 | | WeatherGuard Repairs | Lincoln | Weatherproofing and sealing | ( 555) 567-8901 |

Frequently Asked Questions (FAQ)1. How typically should I have my bifold doors checked?It's suggested to examine bifold doors a minimum of when a year for indications of wear and tear. 2. Can I repair bifold doors myself?While small changes can be tried, intricate concerns are best delegated professionals for safety and efficiency. 3. What are the typical costs connected with bifold door track adjustment door repairs?Repair expenses can differ, but anticipate to pay anywhere from ₤ 100 to ₤ 500, depending on the nature of the repair.  4. How can I prevent future bifold door issues?Regular maintenance, including cleaning tracks and lubing rollers, can significantly extend the life expectancy of your bifold door knob repair doors.  5. Do bifold door technicians use emergency services?Many professional services do provide emergency repairs. Be sure to inquire about this when hiring. Bifold doors are a gorgeous and functional addition to any space, but they require routine maintenance and timely repairs to remain in ideal condition. Knowing the common issues, advantages of professional services, and how to select a certified repairman can save you time, money, and trouble in the long run. Keep this guide in mind, and ensure your bifold doors continue to operate flawlessly for many years to come!

작성일 Date 09:18

byDarren Abt

view more

|

Darren Abt |

|

472079 |

|

본문내용 Exploring Nearby Double Glazing: Enhancing Energy Efficiency and ComfortIntroIn the last few years, double glazing has actually emerged as a popular choice for property owners intending to improve energy efficiency and improve their living environments. The phenomenon of close-by double glazing links house owners with regional suppliers, professionals, and services that focus on double-glazed doors and windows. This short article aims to check out double glazing specialists glazing, its advantages, installation alternatives, and what to think about when searching for neighboring services. What is Double Glazing?Double glazing is a type of window building and construction involving two panes of glass separated by an area filled with air or gas, such as argon. This style reduces heat loss, lessens noise, and increases total window efficiency. Double glazing has ended up being a basic feature in homes due to its range of advantages. Benefits of Double Glazing| Advantage | Description |

|---|

| Energy Efficiency | Lowers heat loss, leading to lower energy costs. | | Sound Reduction | Decreases external noise, developing a quieter interior. | | Improved Security | Harder glass makes it more difficult to get into homes. | | Environmental Impact | Decreases carbon footprint by lowering energy intake. | | Increased Property Value | Appealing windows can increase property market value. |

The Importance of Nearby ServicesWhen considering double glazing, property owners often look for close-by services to simplify the procedure of installation and upkeep. Local providers and specialists provide several advantages, consisting of: - Accessibility: Local services are more accessible for assessments, measurements, and follow-up visits.

- Quick Response: Being close-by ways much faster action times for questions and emergency situation repair work.

- Neighborhood Trust: Local businesses typically count on community track record, making sure a greater level of service quality.

Aspects to Consider When Choosing Nearby Double Glazing Services- Credibility and Reviews: Check online reviews and request suggestions from friends and family to evaluate the quality of service supplied.

- Experience and Qualifications: Ensure that the installers have the needed experience and certifications in double glazing.

- Energy Ratings: Look for affordable double glazing glazing items with high energy efficiency ratings, which can impact future energy expenses.

- Service warranty and Support: Verify the terms of the warranty and what assistance is readily available after installation.

- Cost Estimates: Request multiple quotes to compare costs and ensure competitive prices.

How Double Glazing WorksDouble glazing resolves a mix of concepts, mainly insulation and thermal effectiveness. Here's a breakdown of the parts: - Two Glass Panes: The 2 panes trap air (or gas) between them, producing an insulating barrier that decreases the transfer of heat.

- Low Emissivity Glass: Many double glazing windows are covered with a low-emissivity (Low-E) coating that shows heat back into the room, additional enhancing performance.

- Spacer Bars: These bars keep a constant gap in between the glass panes. They also contribute in decreasing heat transfer.

Installation ProcessThe installation procedure for double glazing normally involves the following steps:  - Initial Consultation: Homeowners talk to regional professionals to go over requirements, choices, and any particular issues with existing windows.

- Measurements: Accurate measurements are taken to guarantee an ideal suitable for the new double glazing installers-glazed units.

- Window Selection: Homeowners select from different designs, designs, and energy rankings.

- Elimination of Old Windows: Existing windows are thoroughly removed to prevent damage to surrounding structures.

- Installation of Double Glazing: The new double-glazed windows are fitted and sealed to guarantee no spaces for air or water infiltration.

- Final Inspection: A final examination is performed to ensure that the installation fulfills all safety and quality requirements.

Upkeep Tips for Double GlazingDespite the fact that double-glazed windows are typically low maintenance, a little care goes a long way in extending their life expectancy. Here are some maintenance ideas:  - Regular Cleaning: Clean the glass with a soft cloth and non-abrasive cleaners to maintain clarity.

- Check Seals: Inspect the seals around the windows for signs of wear or damage to prevent energy loss.

- Condensation Checks: If condensation appears in between the panes, it may show a failure in the seal and should be dealt with without delay.

- Hardware Maintenance: Lubricate locks and hinges to make sure smooth operation and security.

Often Asked Questions (FAQs)1. Just how much does double glazing expense?The expense of double glazing varies based on the size, type, and complexity of installation. Usually, homeowners might spend in between ₤ 400 and ₤ 1,200 per window, consisting of installation. 2. The length of time does double glazing last?Premium double glazing can last 20 years or more, depending upon the materials utilized and the ecological conditions of the installation site. 3. Can I install double glazing myself?While DIY installation is possible, it is not advised due to the precision required for appropriate fitting and sealing. Employing a certified specialist guarantees better results and compliance with structure regulations. 4. What are the energy efficiency rankings for double glazing?Double glazing is ranked based on the U-value, which measures insulation performance. A lower U-value shows better insulation. Look for windows with a U-value of 1.6 W/m ² K or less for optimal energy efficiency. 5. Exist various designs of double glazing?Yes, double glazing can be produced in different designs, consisting of casement, sash, tilt-and-turn, and bay windows, permitting property owners to select based upon architectural requirements and personal choices. Investing in nearby double glazing services can significantly boost energy effectiveness, convenience, and security in homes. By considering regional service providers and understanding the advantages, installation procedures, and maintenance tips, property owners can make educated decisions that add to a more sustainable and satisfying living environment. Double glazing is more than just a window feature; it's an action toward a greener future, and finding the best local service can make all the distinction.

작성일 Date 09:17

byBooker Delgadil…

view more

|

Booker Delgadil… |

|

472078 |

|

본문내용 The Controversial Topic of Buying a Driving License: An Informative GuideIn today's hectic world, having a driving license is frequently vital. It not just opens doors to movement but likewise broadens job opportunity. Nevertheless, the topic of purchasing a driving license has ended up being significantly questionable. In this article, we will explore the implications of buying a driving license, the legality surrounding it, the risks included, and comment acheter un permis de conduire français un véritable renouvellement du permis de conduire français permis de conduire en france permis de conduire provisoire français validité du permis de conduire français - relevant resource site - respond to some common questions related to this issue. Comprehending the Process of Acquiring a Driving LicenseTypically, obtaining a driving license involves a standardized process that differs by nation or state, however typically consists of the following actions: | Step | Description |

|---|

| 1. | Pre-Licensing Education: Take a driving education course that might include both theoretical and practical components. | | 2. | Student's Permit: Pass a composed test to obtain a learner's permit, enabling the candidate to practice under guidance. | | 3. | Practice Hours: Complete the needed number of driving hours with a certified adult. | | 4. | Practical Driving Test: Schedule and pass a driving test with an official inspector. | | 5. | Issuance of License: Upon passing all tests and satisfying requirements, get the driving license. |

While this process is well-structured and developed to make sure that brand-new chauffeurs are proficient, some individuals think about an alternative path: acquiring a driving license outright. The Appeal of Buying a Driving LicenseThe appeal of buying a driving license typically originates from a number of motivators: - Time-Saving: The desire to bypass the prolonged testing and education requirements.

- Benefit: For those who may have trouble passing tests due to health issues, stress and anxiety, or other barriers.

- Desperation: Individuals in immediate requirement of a license for employment or personal reasons might feel obliged to turn to illicit opportunities.

The Risks InvolvedWhile the temptation to purchase a diving license might be easy to understand, it comes with considerable risks. Here are some essential points to consider: | Risks | Description |

|---|

| Legal Consequences: Buying a driving license is illegal in lots of jurisdictions. This can result in large fines, criminal charges, and even jail time. | | | Safety Issues: A bought license might not represent true driving abilities, possibly causing mishaps and endangering lives on the road. | | | No Legal Recognition: A fake or invalid license will not be acknowledged by authorities, rendering it useless and potentially putting the holder at danger of being pulled over or mentioned. | | | Future Implications: Legal difficulties can impact one's ability to secure future employment, housing, or other chances that need background checks. | |

Understanding the Legal FrameworkThe laws surrounding driving licenses can differ substantially between countries. For circumstances: | Country/Region | Legal Approach |

|---|

| United States | Each state has its own requirements; purchasing a license illegally can lead to criminal charges. | | UK | The DVLA strictly manages license issuance, and prohibited deals are prosecuted. | | Australia | Comparable to the UK, strict laws are implemented, and the charges for scams can consist of imprisonment. |

Before considering any actions, it's important for people to completely comprehend the legal framework governing driving licenses in their particular locations. Frequently Asked Questions (FAQ)1. Can I legally purchase a driving license?No, purchasing a driving license is illegal in most jurisdictions. Legal requirements need to be met through proper screening and education. 2. What are the effects if I'm captured with a purchased license?Legal consequences can include criminal charges, fines, and even jail time, depending on the intensity of the offense and regional laws. 3. Exist genuine options to purchasing a license?Yes, legitimate options consist of seeking help from a driving school, practicing with a certified instructor, or resolving any individual obstacles that might prevent passing the needed tests. 4. Can my driving record be affected if I hold a bought license?Yes, your driving record will be compromised. A purchased license is likely not connected to any real driving history or safe driving practices, which can have severe consequences if you get into a mishap or are pulled over by police. 5. How can I guarantee I am properly gotten ready for the driving test?Preparation can include taking driving education courses, experimenting certified people, studying the vehicle code particular to your place, and going through mock tests. Alternatives to Buying a Driving LicenseRather of resorting to illegal approaches, there are numerous legal alternatives to think about: Enroll in a Driving School: Professional driving schools offer training courses that can considerably enhance driving abilities and knowledge. Practice with a Licensed Driver: Spend time behind the wheel with a qualified chauffeur to acquire experience and self-confidence. Online Resources: Utilize online tutorials, driving simulators, or training videos to familiarize oneself with driving regulations and strategies. Mindfulness and Anxiety Management: For those with test anxiety, think about participating in mindfulness practices, therapy, or preparatory courses focused on test-taking methods.  Seek Support From Friends and Family: Getting motivation from enjoyed ones might increase confidence and lower stress and anxiety surrounding the driving tests.

While the temptation to buy a driving license may seem interesting some, the dangers and legal consequences far exceed any immediate advantages. A legitimate driving license ensures that people are properly trained and safe to drive on public roadways, benefiting everybody in the community. By following the recognized procedures to obtain a license, people can not just enhance their opportunities of success but likewise add to roadway safety. Through preparation and resilience, obtaining a driving license legally is a a lot more prudent option.

작성일 Date 09:17

byKattie

view more

|

Kattie |

|

472077 |

|

본문내용  The Benefits of Buying Used Wooden Pallets: A Comprehensive GuideIn an age where sustainability and cost-effectiveness are at the leading edge of lots of services' operations, making use of wooden pallets has actually become a wise choice for different markets. Buying used wooden pallets not just assists reduce waste but likewise offers organizations with a useful option for their shipping, storage, and display needs. This post will go over the numerous advantages of going with used wooden pallets, the different types offered, tips on purchasing, and regularly asked questions to help you make notified choices. Table of Contents

The Advantages of Used Wooden Pallets | Advantage | Explanation |

|---|

| Expense Savings | Used wooden Wood Pallets Sale are considerably cheaper than new ones, allowing organizations to save cash. | | Eco-Friendly | By acquiring used pallets, organizations add to environmental sustainability and waste reduction. | | Flexibility | Wooden Pallets Clearance pallets can be used for a range of purposes, from shipping and storage to DIY jobs. | | Durability | Wooden pallets are robust and can hold up against heavy loads, making them a dependable option. | | Customization | Used pallets can be easily customized or repurposed, permitting for innovative applications. |

Buying used wooden pallets offers a host of benefits, beginning with substantial cost savings. Businesses seeking to handle their budget plans can Find Wooden Pallets that used pallets are offered at a fraction of the cost of new ones, making them a smart financial investment. Beyond financial factors to consider, purchasing used pallets aligns with environment-friendly practices. By selecting previously owned materials, companies help in reducing the demand for new lumber, thus saving valuable natural resources. Additionally, wooden pallets are incredibly versatile. They can serve multiple functions, whether for warehousing, transport, or crafting. Their toughness likewise suggests they can manage substantial weight and wear, making them ideal for the shipping market. Finally, the modification potential of wooden pallets need to not be neglected. Creative minds can change them into furniture, gardening structures, and ornamental items, expanding their utility beyond conventional uses. Types of Wooden Pallets When it comes to wooden pallets, there are numerous types offered for services and individuals alike. Comprehending these types can assist in choosing the best pallet for particular requirements: | Pallet Type | Description |

|---|

| Double Face Pallet | Pallet with two usable sides, perfect for much heavier loads. | | Single Face Pallet | Pallet with one functional side, normally lighter and more economical. | | Block Pallet | Features wooden blocks in the corners, supplying more strength and stability. | | Stringer Pallet | Constructed with a series of boards (stringers) that offer support. | | Euro Pallet | Standardized size (1200mm x 800mm) for international shipping in Europe. | | Customized Pallet | Tailored to particular measurements and requirements for unique applications. |

Each type of Wooden Pallets Shop pallet serves a particular function, making it necessary to choose wisely based upon the planned usage. For example, block pallets use more stability compared to stringer pallets, making them appropriate for much heavier loads. On the other hand, Euro pallets are standardized for global shipping, streamlining logistics for exporting goods. Tips for Buying Used Wooden Pallets Purchasing Used Pallets Buy wooden pallets can be a simple procedure, but certain factors to consider can assist you make much better choices. Here are some suggestions to follow: Evaluate Condition: Inspect pallets for indications of damage, mold, or insect infestations before purchasing. Avoid pallets that are split, broken, or considerably wearied. Look for Compliance: Ensure the pallets satisfy market requirements, including accreditation for global shipping (ISPM 15) if applicable. Identify Size Requirements: Consider the size and weight limits you require based upon your meant use of the pallets. Buy wholesale: If you need numerous pallets, think about purchasing wholesale to minimize expenses and potentially receive a discount. Research Suppliers: Look for dependable providers or recycling centers known for quality used pallets. Checking out customer evaluations can offer insight into their reputation. Transport Costs: Factor in the transport costs to your place, as this can substantially impact total costs. Understand Return Policies: Familiarize yourself with the supplier's return policy in case the pallets do not meet your expectations or particular needs.

By adhering to these pointers, purchasers can prevent common mistakes and make the most of the advantages obtained from buying used wooden pallets. Often Asked Questions Q: Can used wooden pallets be reused for food products?A: Yes, however it's crucial to make sure the pallets comply with food security policies and are devoid of contamination. Try to find pallets that are specifically marked for food use. Q: How can I clean used wooden pallets?A: Thoroughly tidy pallets bygetting rid of dirt and particles, then disinfect them with a service proper for the planned use, particularly if they will enter into contact with food. Q: Are used pallets for sale in all areas?A: Availability varies by place, however many suppliers or recyclers existin metropolitan areas. It's recommended to check local

listings and online markets. Q: What are the best practices for pallet storage?A: Store pallets in a dry, ventilated area and stack them appropriately to avoid damage and assist in ease of gain access to. Q: How long can wooden pallets last?A: The life expectancy of a wooden pallet

varies widely depending on usage and upkeep however can range from 5 to 15 years or more. In conclusion, buying used wooden pallets can be a resourceful

and affordable method for organizations of all sizes. By comprehending the benefits and terms connected with wooden pallets, making an informed choice becomes easier and more effective. With close consideration and cautious buying tips, companies can make the most out of their financial investment, contributing favorably to both their bottom line and the environment.

작성일 Date 09:15

byDianna

view more

|

Dianna |

|

472076 |

|

본문내용 Special Offers on Sofas: Finding the Perfect Deal for Your HomeSofas are a main furniture piece in any living space, supplying comfort, style, and performance for household and good friends alike. However, acquiring a brand-new sofa can be a substantial investment. Whether you're looking to update your living-room, provide a visitor space, or simply want a change in aesthetic, special offers and deals on sofas can make this financial investment a more manageable one. This article dives into different sources of special deals on sofas, the types of deals readily available, ideas for making the most of savings, and typical questions that buyers might have. Understanding Special Offers on SofasSpecial offers can manifest in different ways. Merchants often supply discounts, promotions, seasonal sales, and liquidation events to bring in customers. Comprehending the types of offers offered is essential for making an informed purchase. Types of Special Offers on SofasSeasonal Sales: Many retailers have seasonal sales throughout the year, such as Labor Day, Black Friday, and holiday shopping events. Inventory-clearance sale: This is frequently a chance to buy sofas at substantially reduced rates. These sales occur when retailers require to make room for new stock.  Bundled Offers: Some retailers provide discounts when buying a sofa in addition to complementary pieces like chairs or coffee tables. Advertising Discounts: Retailers may run advertising projects (like percentage off the market price or dollar-off discounts) to attract consumers. Online Exclusive Deals: Many online shops provide unique deals that are not available at physical places. Funding Offers: Interest-free funding choices can be an attractive way to purchase more affordable in time. Email Newsletters: Subscribing to sellers' newsletters often grants access to Special Offers On Sofas [www.ciaralindsay.top] promotions and early announcements about sales.

Where to Find Special Offers on SofasThe next question for numerous purchasers is where to search for these special deals. Here are some popular locations to shop: Physical Retail Stores- Big Box Retailers: Stores like IKEA, Costco, or Home Depot usually have routine sales and promotions.

- Furniture Showrooms: Visiting regional furniture display rooms can often offer access to inventory-clearance sale or flooring design discounts.

- Department Stores: Chains like Macy's or JCPenney may offer seasonal furniture sales.

Online Retailers| Seller | Strengths | Noteworthy Offers |

|---|

| Wayfair | Vast selection and customer reviews | Frequent flash sales | | Amazon | Price comparisons and user scores | Lightning deals | | Overstock | Discounted costs on overstock items | Extra discount offers | | AllModern | Trendy designs and modern aesthetic appeals | Seasonal clearance sales | | Short article | Quality sofas with limited-time offers | Free shipping on sales |

Regional Classifieds and Marketplaces- Facebook Marketplace: Local sellers may offer sofas at a fraction of list prices.

- Craigslist: This site can be a goldmine for second-hand gems, although it's essential to work out care and confirm the condition.

- OfferUp: Similar to Craigslist, this app enables for local sales and can feature both brand-new and pre-owned sofas.

Optimizing Your Sofa SavingsTo take advantage of your sofa budget, think about the following pointers: Research Prices: Compare rates throughout different retailers to ensure you're getting a bargain. Timing is Key: Shop throughout vacation weekends or at the end of a season when merchants aspire to clear out stock. Negotiate: Don't think twice to ask for a discount or ask about other continuous promotions. Evaluation Return Policies: Before acquiring, check the return policy to guarantee you can restore the sofa if it does not fit your space or design. Take Advantage of Gift Cards or Loyalty Points: If you have gift cards or loyalty points, utilize them to lower your overall expense.

Frequently Asked Questions about Sofa OffersWhat is the best time to buy a sofa?The very best times to purchase a sofa are throughout vacation weekends (like Memorial Day, Labor Day, and Black Friday) and at the end of winter season or summer when inventory-clearance sale are common. Are online deals for sofas trusted?Yes, lots of trusted online retailers provide dependable deals. Always check customer reviews and return policies before buying. How can I ensure the sofa will fit in my space?Before purchasing, determine your space and think about not simply the sofa measurements however also the doorway and stairwell through which the sofa will require to pass. Is it much better to purchase a sofa online or in-store?Both have their benefits. Online shopping offers benefit and typically much better special offers, while in-store shopping allows you to physically inspect and sit on the sofa. What should I search for when purchasing a sofa?Look for quality in the materials and construction, convenience, design that suits your home, and guarantee info. Discovering the best sofa can be a satisfying albeit challenging undertaking. With a keen eye for special offers, potential purchasers can access considerable savings that make buying a brand-new sofa more manageable and pleasurable. By remaining informed about seasonal sales, understanding the kinds of offers offered, and exploring numerous retail opportunities, anybody can transform their living area without breaking the bank. Navigating this buying procedure with diligence and a little research study can cause a beautifully provided home and a wise financial investment for many years to come.

작성일 Date 09:15

byYong

view more

|

Yong |